Welcome To This Week’s Chartbook!

Click the links below for market & sector-specific chartbooks:

| Large Cap | Small Cap | Value | Growth | Comm Srvs |

| Discretionary | Staples | Energy | Financials | Health Care |

| Industrials | Tech | Materials | Real Estate | Utilities |

| MSCI ACWI | MSCI EAFE | TSX Comp | Nikkei 225 | MSCI China |

Must-See Charts Of The Week

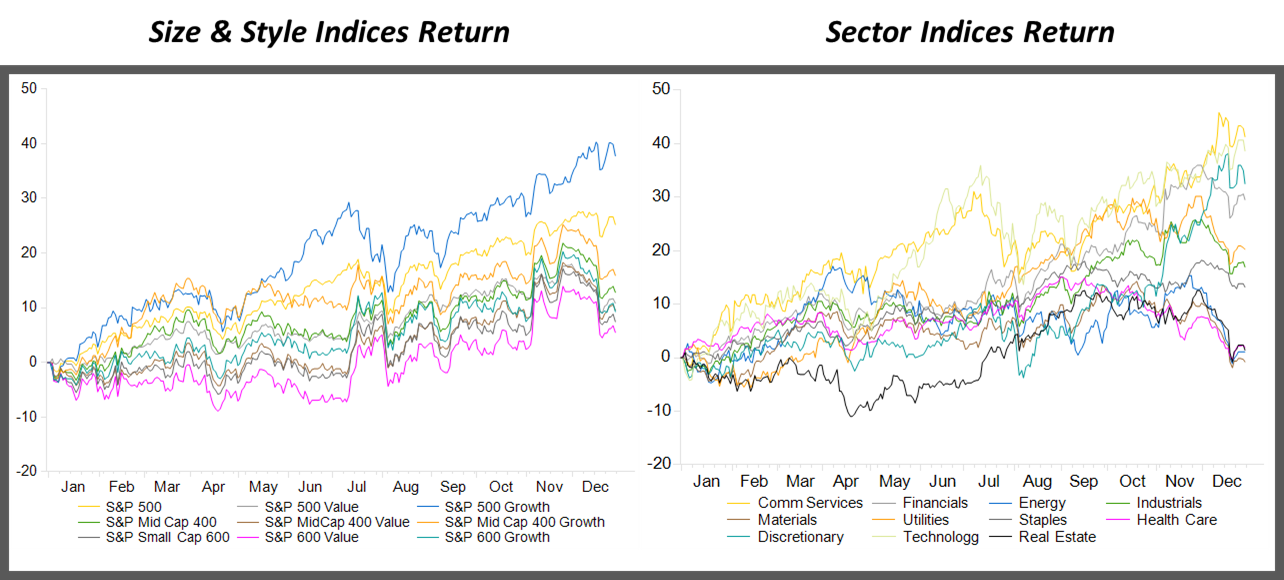

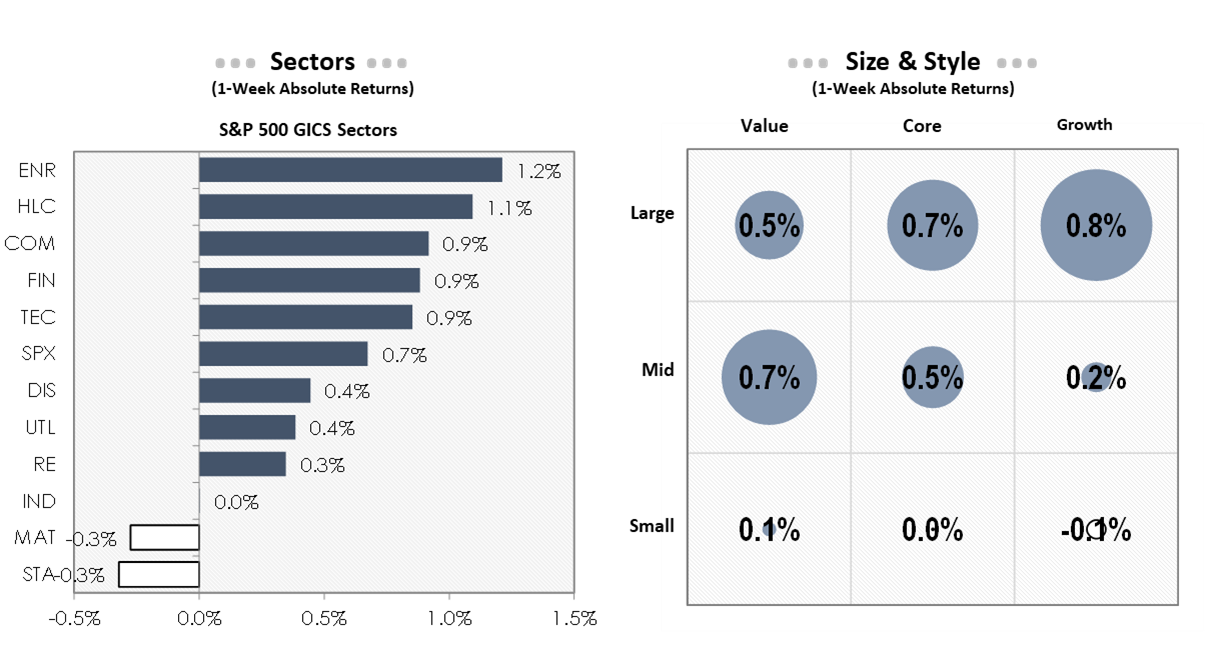

Hard to believe there are only 2 more trading days left in ’24. Looking back, it was a pretty good year overall for headline equity indices with the S&P size and style benchmarks all up. While most S&P equity indices were up, dispersion across size, style and sectors was enormous in ’24.

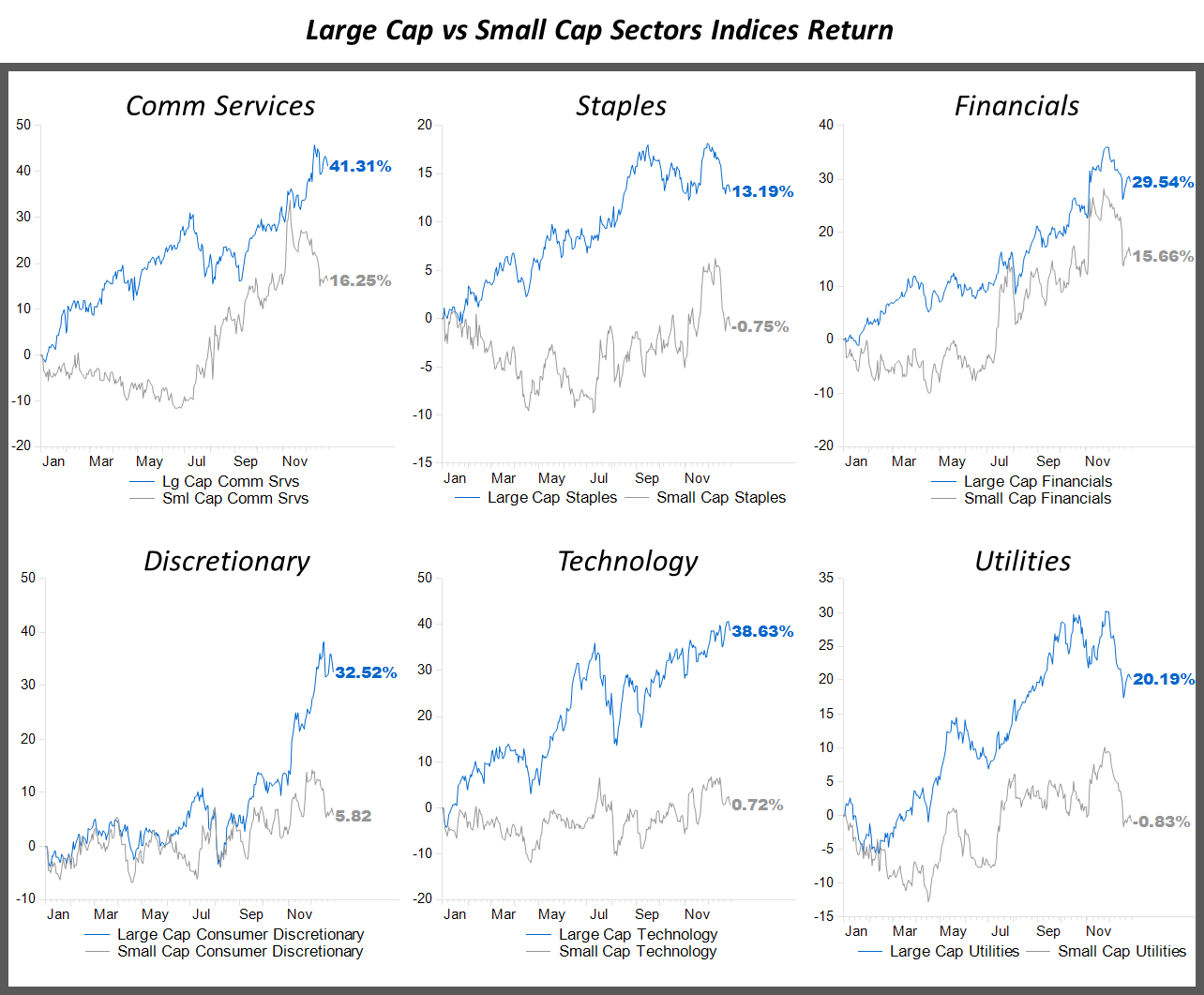

The dispersion in sectors in ’24 was not just across sectors (i.e. Tech vs Staples) it was also significant within sectors (i.e. Large Cap Staples vs Small Cap Staples).

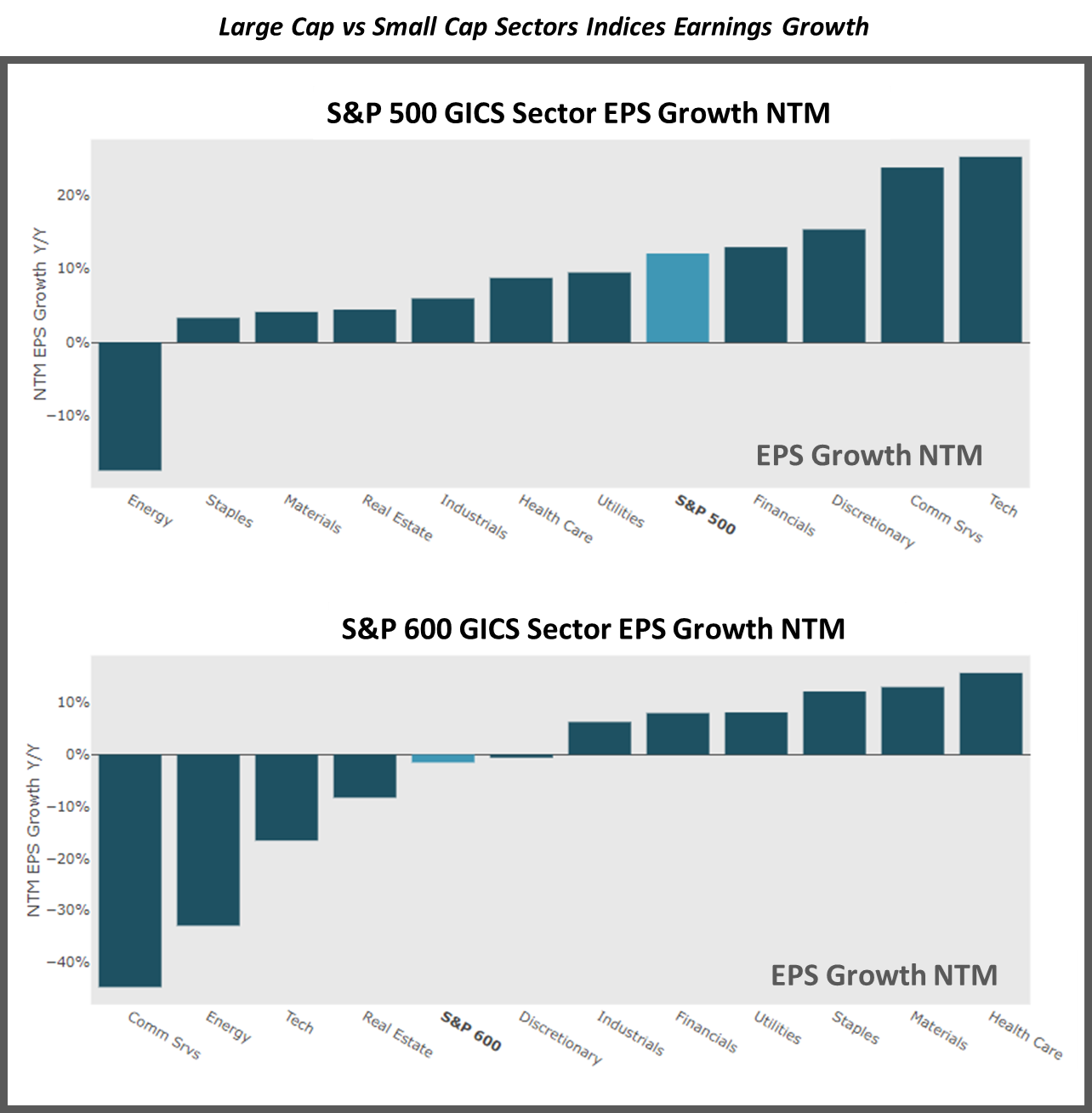

Looking ahead, earnings expectations for sectors are signaling more of the same for ’25 in terms of sector dispersion.

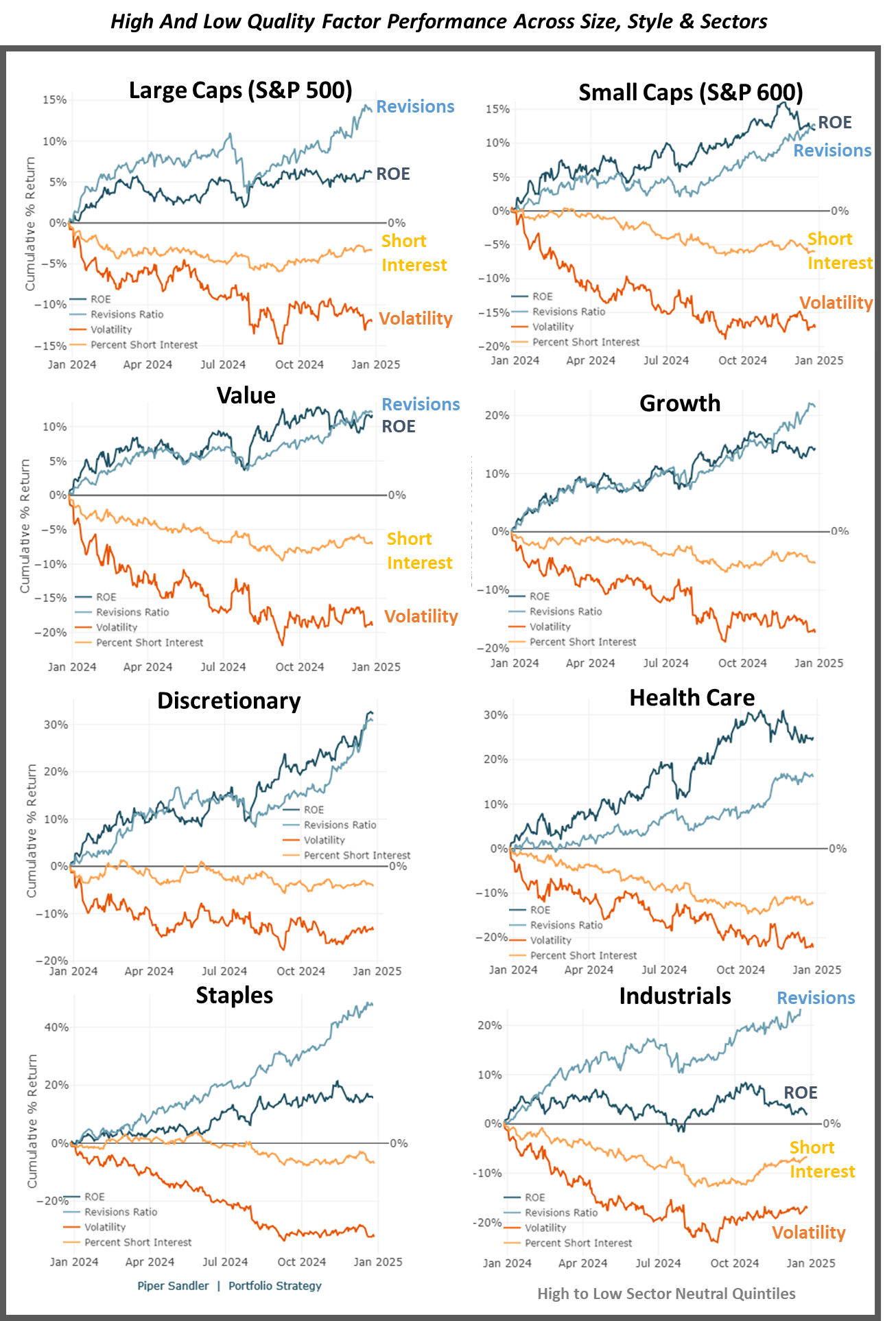

While size, style and sector returns were highly varied in ’24, we did see remarkable consistency in factor performance in nearly every corner of the market. Positioning in ’24 was mainly driven by higher quality factors over lower quality factors.

Strategy Team Notes From Last Week

Must-See Charts Of The Week! (Earnings)

The Week In Review

| Michael Kantrowitz, CFA | Stephen Gregory | Emily Needell, CFA | Joe Ramirez, CFA | Dan Nivasch |

| Michael.Kantrowitz@psc.com | Stephen.Gregory@psc.com | Emily.Needell@psc.com | Joe.Ramirez@psc.com | Dan.Nivasch@psc.com |

| 212 257-4971 | 212 257-4972 | 212 257-4974 | 212 257-4975 | 212 257-4973 |